“In Bangladesh, the women don’t even make up 1 percent of bank borrowers, so we thought we should address the issue through our program,” commented Muhammed Yunus, founder of Grameen Bank, after receiving the Nobel Prize.

Women and Poverty

Poverty has always been a global problem, and gender undoubtedly serves as an essential indicator in understanding this challenge. Global poverty continued to have a “female face” until the end of the Cold War, as there was a great contrast between women’s hard work in the labor market and the income and wealth they earned.

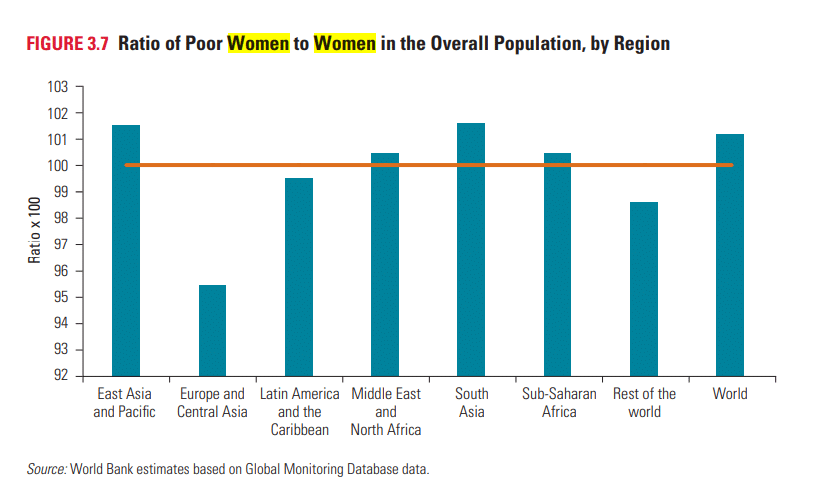

Women are overrepresented among the poor globally and across most regions of the world. While Europe and Central Asia, Latin America and the Caribbean, and other high-income countries have low female poverty rates, East Asia, the Pacific, South Asia, and Sub-Saharan Africa have high female poverty rates, as shown in Figure 3.7. Globally, women are also overrepresented among the poor in almost every region.[1]

In China, there are still many women facing unemployment and social problems. In fact, women are more likely to be in relative poverty. Therefore, we should take gender into consideration when solving relative poverty problems. Since 1990, women’s income in rural areas has been lower than men’s, and the income gap between the two genders has dramatically increased. But women’s income in rural areas had increased by 21.8 percent in 1999, compared with the data in 1990. After a decade, the figure from 2010 had increased by 25.4 percent.

Although rural women work more hours than men, overall the gap between men and women’s income has increased by 8 percent.

The complexity of poverty

As poverty becomes more complex and multidimensional, social issues cannot be considered as a shortage of money – but of rights inequality. Hence, we believe that women’s empowerment, in addition to increasing women’s incomes, has been a vital method for alleviating female poverty.

The Chinese definition of poverty may help us understand the relationship between income poverty and multidimensional poverty. The Analytical Dictionary of Characters defines poverty (贫困,pin kun) as “little wealth”. The Xinhua Dictionary defines “poor” (贫,pin) as “little income and difficulties in life”. It describes “predicament” (困,kun) as “falling into a harsh environment or any environment that one cannot escape”. Thus, the “poor” aspect of poverty mainly refers to the lack of income, and the “predicament” aspect of poverty emphasizes the social environment. According to the Chinese definition, poverty can be defined as “falling into a harsh environment or any environment that one cannot shake off due to little income or wealth” (Wang 2012). Similarly, this paper believes that poverty includes not only a lack of income but also social predicaments. [4]

This also means that the current practice of targeted poverty alleviation is required to realize women’s economic empowerment and participation, and for focusing on the multidimensional poverty phenomenon that focuses on women in the process of modernization and transformation.

Based on this ideology, Grameen Bank, as a pioneer in the realm of innovative micro-finance, created an ideal path for female empowerment by employing the financial approach.

Grameen Bank and the empowerment of women

With its pioneering microfinance model, Grameen Bank has become a typical representative of women’s empowerment practices worldwide — by using the power of microfinance to help women overcome the threshold of entrepreneurship and clear the way to self-sufficiency.

Traditional banks, especially in Bangladesh, mainly serve men. Grameen Bank focuses on women, giving them the opportunity to become entrepreneurs and lift their families out of poverty. Traditional banks regard the poor as untrustworthy. However, Grameen Bank proved for the first time in history that impoverished people, especially impoverished women, were creditworthy and had much higher loan-repay rates than male borrowers – even than borrowers who were richer. By August 2021, Grameen Bank had 9.41 million members, of which 97 percent were female. And it currently operates 2,568 branches serving 81,678 villages, covering 93 percent of villages in Bangladesh. [6]

Grameen Bank aims to empower women by combining financial media and social media. The success of the bank lies not in its discovery that the poor are creditworthy, nor in the way it operates, but in its profound grasp of how to expand the social capital (social network) of the poor, and the sophisticated design of the mechanism for doing so.

By taking advantage of microfinance and constructing community networks, Grameen Bank offers its members adequate resources, such as funding, consulting, and personnel.

In terms of funding, Grameen Bank adopts micro-credit and inclusive finance to provide people with sufficient funds to start their own business. In addition, the bank provides financial advice to help its members select profitable industries to invest in and gives practical business advice to help them find the right way to grow. Members who benefit from the services can join a specific network of people. In their network, members can find like-minded people in similar situations, as well as being able learn from their business partners and others.

After several years of effort, many Grameen members have experienced quite a transformation. They now have more confidence and education has helped them to succeed in their profession. The most important result was a change in the way they think about themselves. They began to realize that they didn’t need to be full-time housewives who had to take care of children and do housework all the time. Instead, they realized that they had the right and the ability to realize their own value.

For example, Ms. Wan joined Grameen in 2014. Before she joined, Wan was selling pancakes in Xuzhou, China. Every day, she had to get up at 4 am to prepare the ingredients for the day’s business and stand on the street for several hours selling her products. But selling pancakes only helped her make a basic living.

However, in 2014, she was diagnosed with stomach problems and had to find a less physically demanding way of making a living. Grameen Bank stepped in and “saved her life”. Following the advice of experts, she decided to raise pigs. However, during that year, many pigs died due to swine fever. Then, Grameen Bank held a group meeting to gather members who had similar experiences and helped Ms. Wan to find a practical solution. In the end, they managed to sell her pigs, even in the midst of a livestock recession.

She said that she was grateful for the bank’s efforts to help her find a trade. She also met her good friend, who is also her business partner. She realized that her life was not limited to doing housework and other complicated things. She felt confident to hold a new title – businesswoman or entrepreneur. She also says that connecting with other members and doing business with them has helped her to be spiritually fulfilled and more involved in her community.

The significance of investing in women

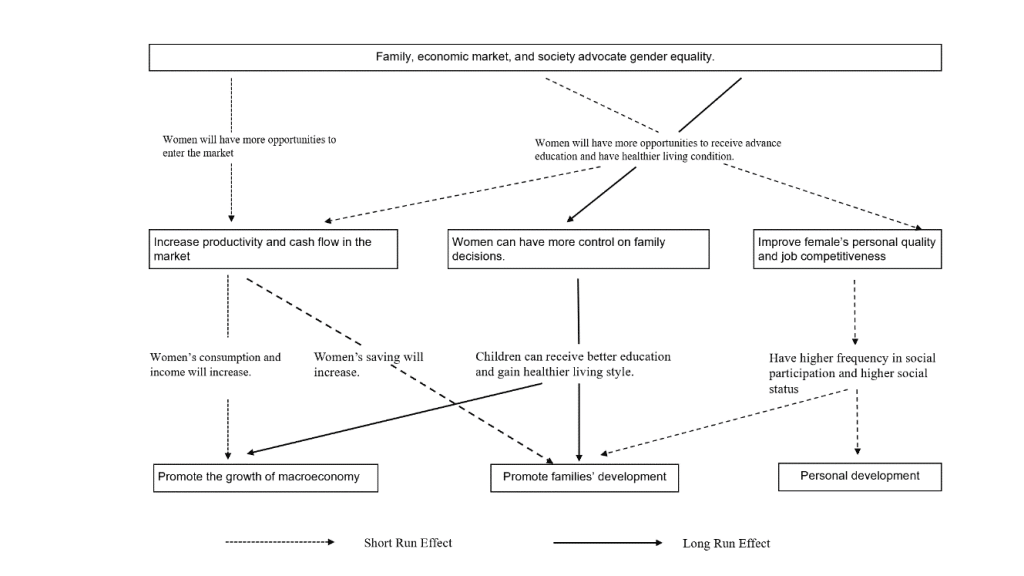

There is a considerable body of research that demonstrates that female empowerment could generate many positive externalities benefitting people around the world as well as future generations. The increase in women’s participation in the labor face not only contributes to social and economic development at the macro level, but also contributes to the improvement of women’s individual qualities and comprehensive personal development at the micro level. And within families, it helps to improve health, and increases investment in children’s education, which eliminates the intergenerational transmission of poverty. [7]

Other countries and regions are also trying to help women gain capital through different financial programs.

In Singapore, the Impact Investment Exchange (IIX) arranged for the issuance of the Women’s Livelihood Bond (WLB) in 2017, which assesses the impact of the WLB based on indicators related to the Sustainable Development Goals (SDGs), including SDG Goal 5 (gender equality), SDG Goal 8 (decent work and economic growth) and SDG Goal 17 (promoting the achievement of the goals). The Women’s Livelihood Bond aims to empower 385,000 women in Cambodia, Vietnam, and the Philippines by increasing women’s access to credit, markets, and affordable goods and services.

Mercy Corps, an international non-governmental organization, created the “Building Resilience Through the Integration of Gender and Empowerment” ( BRIGE) program in West Nusa Tenggara Province, Indonesia. The BRIGE project aims to promote inclusive microfinance.

Mercy Corps connects Bank Perkreditan Rakyat, Indonesia’s national rural bank, with local women’s agricultural cooperatives. The bank, which has a flexible and gender-compliant policy, offers a group-based mobile service that provides customized training sessions for women on the benefits of saving and the importance of ensuring a good repayment record. One local woman who participated in BRIGE’s program said, “I now understand that hiding money under my pillow doesn’t work, and that I need to keep it in the bank instead.”

Investing in women is a tremendous opportunity to transform and improve the well-being of half of the global community.

“After we achieved that, money going to the family through women brought so much more benefit to the family than the money going to the family through men. Women took good care of their children as their income increased, so we focused on women. As a result, out of the 7 million borrowers we have, 97 percent of them are women, and it works beautifully. All objectives are focused on helping the family escape poverty, so if you bring women into the picture, if you empower women, it happens faster than it happens the other way,” argued Muhammed Yunus.

“Support and help should not just be unemotional skills training, but also the acquisition of human dignity and the confirmation of self-worth. Women who can participate in public affairs and speak up for themselves will slowly develop self-esteem and confidence in meetings. Finance should not only be limited to rational calculation but also play a greater social role as a custodian of social assets and supporter of social values,” said Qingzhen Ge, an adviser to the Yunus Foundation.

References

[1] Poverty and Shared Prosperity 2020,https://www.worldbank.org/en/publication/poverty-and-shared-prosperity

[2]王爱君:《市场经济转型中的农村妇女贫困——基于社会性别主流化视角》,中国社会学年会“性别发展与美丽中国建设” 论坛论文集,2013 年。

[3] 国家统计局住户调查办公室:《2011 中国农村贫困监测报告》,北京:中国统计出版社,2011 年,第 41 页。

[4] Wang, Xiaolin, Hexia Feng, Qingjie Xia, and Sabina Alkire., 2016. “On the Relationship between Income Poverty and Multidimensional Poverty in China.” OPHI Working Paper, no.101.

[5] 徐秀丽.(2016).社会性别视角可为精准扶贫实践提供三重贡献. 妇女研究论丛(06),8-9. doi:CNKI:SUN:FNYJ.0.2016-06-003.

[6] https://grameenbank.org/introduction/

[7] 石智雷 & 张婷皮美.(2020).性别红利:理解社会经济发展的新视角. 中南财经政法大学学报(03),61-70+159. doi:10.19639/j.cnki.issn1003-5230.20200427.008.

[8] https://mp.weixin.qq.com/s/bm0Ap2pJCvwkoNSqmQFS3Q

[9]中南屋调研https://mp.weixin.qq.com/s/Ns55ZNN4aQmCax73UX-TEA

[10]UN Department of Economics and Social Affairs Division for Social Policy and Development, Empowerment – the United Nations, https://www.un.org/esa/socdev/ngo/outreachmaterials/empowerment-booklet.pdf

[11]Yixuan Shen, 【中南屋调研】社群中的小额贷款:徐州格莱珉的乡村女性赋权之路,https://www.kuaihz.com/tid5/tid499_812763.html

[12]Wharton, University of Pennsylvania 2013年01月30日 金融与投资. (n.d.). 小额信贷和男权: “偏离为妇女服务的方向.” 简体中文. Retrieved December 7, 2021, from http://www.knowledgeatwharton.com.cn/article/3375/.

[13] https://www.worldbank.org/en/publication/poverty-and-shared-prosperity

[14] https://www.worldvisionmicro.org/microcredits-the-ultimate-tool-to-end-poverty/

[15] http://www.grameenchina.cn/h-nd-330.html#_np=2_321

[16] https://posts.careerengine.us/p/5fb6fd99635f6d0351ddd0e2

[17] https://www.unescap.org/news/un-supports-iix-accelerating-its-womens-livelihood-bond-series

[18] https://www.mercycorps.org/research-resources/gender-resilience