Introduction

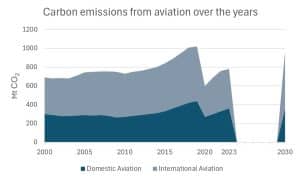

By 2023, the global aviation industry is responsible for about 2.0% of global carbon emissions annually, or about 800 million tonnes of CO2 equivalent, and is expected to return to pre-pandemic levels by 2025 (1.06 billion tonnes in 2019). As the electrification of other modes of transport accelerates, aviation’s share of carbon emissions is expected to continue to rise in the coming decades, becoming an important obstacle to achieving global carbon neutrality by 2050.

Fig1.Changes in annual carbon emissions from the aviation industry from 2000 to 2023 [1]

Therefore, it is urgent to find a carbon reduction solution for the aviation industry. In this context, sustainable aviation fuel (SAF) is seen as a key means to achieve net zero emissions from the aviation industry. The International Air Transport Association (IATA) predicts that the SAF will contribute 65% of the aviation industry’s carbon reduction by 2050. This report provides an in-depth analysis of the advantages of SAF, technical routes, policies and industry status in Europe, the United States and China, and predicts future development trends.

- Advantages of SAF

(1) Environmental protection:

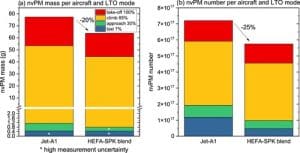

Fig2.Quality and quantity of particulate matter emissions from aircraft using Jet A-1 fuel and 32% HEFA-SPK blend fuel during take-off, climb, approach and taxi [2]

o SAF is produced from renewable raw materials such as waste animal and vegetable oils and municipal solid waste, which can reduce CO2 emissions by about 80% over the life cycle. Unlike fossil fuels, SAFs achieve net zero emissions over their life cycle by recycling carbon dioxide.

o The second generation of SAF is produced mainly by processing waste or carbon capture of the air, does not compete with food crops or water supplies, does not cause forest degradation, and is more sustainable.

o SAF’s extremely low sulphur and aromatic compounds significantly reduce particulate matter (PM) emissions during combustion, improving air quality and reducing health risks.

(2) Compatibility:

o SAF is basically the same as conventional aviation kerosene at the molecular level, and can be used as a blended standard aviation fuel, compatible with existing oil transport, refueling, oil storage facilities and aircraft engines.

o SAF compatibility helps save the cost of redeveloping new engines and allows airlines to continue using existing aircraft to reduce emissions, significantly reducing the cost of a decarbonisation transition.

- Technical route of SAF

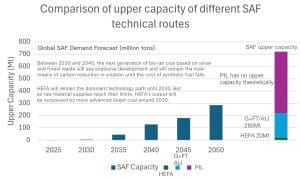

The main technology routes in the SAF market include Hydroprocessed Ester and Fatty Acid (HEFA), Fischer-Tropsch synthesis (G+FT), Alcohol to Jet (AtJ) and Power-to-Liquid (PtL).

(1) HEFA process:

o Through the hydrogenation process to extract animal and vegetable oils, waste oil, etc. to produce SAF, the conversion rate is about 35% to 40%.

o Mature technology, a wide range of raw materials, such as the Ecofining process of Honeywell UOP in the United States, NExBTL process of NexBTL Oil Company in Finland, etc.

o Most of the SAF projects already in production in China use the HEFA technology route and face the challenge of limited raw material supply growth.

(2) G+FT process:

o Synthetic gas (a mixture of carbon monoxide and hydrogen) is used as raw material to produce liquid hydrocarbons or hydrocarbons through the Fischer-Tropsch synthesis reaction.

o technology has mature applications in the chemical field, but the SAF conversion rate is low (about 10% to 15%), and the alkali metal in the raw material is harmful to the catalyst, and the production cost is high.

(3) AtJ process:

o Conversion of alcohols into hydrocarbons, mostly from sugars or starchy crops and agricultural and forestry wastes.

o American companies such as LanzaTech and Gevo adopt this technology, which is suitable for countries rich in agricultural and forestry resources.

o In countries with limited agricultural and forestry resources, such as China, AtJ process costs are higher.

(4) PtL process:

o Use of renewable energy to electrolysis water to produce hydrogen, combined with carbon capture technology to synthesize liquid hydrocarbons.

o Theoretical production capacity is unlimited, production costs will decrease with the increase of green electricity supply, long-term prospects.

o Europe is open to the PtL process, with several projects already in the early stages of engineering.

Fig3.Comparison of upper capacity of different SAF technique routes [3]

- European, American and Chinese SAF policies

(1) International Policy:

The International Aviation Carbon Offsetting and Reduction Scheme (CORSIA) is the world’s first market-based international aviation emissions reduction scheme that stabilises aviation emissions by incentivizing efficient operations and the use of SAF.

The CORSIA plan is voluntary from 2021 and mandatory from 2024, and is expected to cover more than 80% of international flight emissions.

(2) European Policy:

The EU Fit for 55 package, which includes the Emissions Trading System (ETS), ReFuelEU Aviation proposal and the Energy Tax Directive (ETD), aims to promote the application of SAF through mandatory regulations.

The ReFuelEU Aviation proposal calls for a gradual increase in the SAF blending ratio to 70 percent by 2050.

European SAF production is expected to grow rapidly, reaching 9.5 million tonnes in 2030.

(3) U.S. Policy:

The United States provides tax breaks, production subsidies, and research and development support through policies such as the Inflation Reduction Act (IRA), the Sustainable Fuel Standard (RFS)/Low Carbon Fuel Standard (LCFS), and the SAF Grand Challenge.

The U.S. SAF market is dominated by the HEFA process, but is gradually shifting to the AtJ process, with SAF production expected to reach 14 million tons in 2030.

(4) China’s Policy:

China has not yet issued a specific policy for SAF, and SAF development goals are mostly integrated into other energy and environmental policies.

Policies such as the “Action Plan for Carbon Peak before 2030” and the “14th Five-Year Plan for Green Development of Civil Aviation” support the development and application of SAF.

China’s SAF industry is in its infancy, with most of the projects already in production being HEFA process, and plans to transition to G+FT and PtL processes in the future.

- SAF industry in Europe, America and China

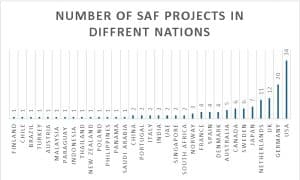

Fig4.Number of SAF projects in different nations [4]

(1) European SAF industry:

The European aviation industry has a huge demand for SAF, and EU policies promote the development of SAF industry, and the number of SAF projects in the country leads the world.

The PtL process has a promising future in Europe, and several large-scale PtL projects have entered the pre-engineering stage.

(2) U.S. SAF industry:

The US aviation market is the largest in the world, and SAF projects are dominated by emerging biofuel companies.

The AtJ process has cost advantages in the United States, and several AtJ projects are commercially operational.

(3) China’s SAF industry:

China’s aviation market is the second largest in the world, and the demand for SAF is huge.

China’s SAF industry started late, but relying on rich waste oil resources, HEFA process dominates in the short term.

In the future, there will be a gradual transition to G+FT and PtL processes to adapt to resource constraints and renewable energy trends.

- SAF’s industrial composition and sustainability certification

The SAF industry consists of three major stakeholders: government, fuel producers and fuel consumers. The government is responsible for setting policy, promoting research and development, and providing financial support; Fuel producers are responsible for raw material procurement and product processing; Fuel consumers create SAF demand and drive the market.

SAF’s sustainability certification systems, including the International Sustainability and Carbon Certification (ISCC) and the Sustainable Biomaterials Roundtable (RSB), ensure the sustainability of SAF production processes and enhance market recognition.

- Future development direction of SAF industry in Europe, America and China

(1) European Union:

o Gradually transition from HEFA process to PtL process, using renewable energy advantages to reduce production costs.

o Strengthen international cooperation to ensure the supply of raw materials and promote the global application of SAF.

(2) United States:

o Transition from HEFA process to AtJ process, using rich biomass resources to reduce costs.

o Build a SAF offtaking system to promote industrial chain cooperation and ensure a balance between supply and demand.

(3) China:

o In the short term, HEFA process is the main process, and waste oil resources are used to meet the initial demand.

o Transition to the G+FT process in the medium term, using agricultural and forestry waste such as straw, while transforming existing coal-to-oil projects to expand capacity.

o Long-term promotion of PtL process development, combined with renewable energy to reduce production costs.

- SAF promotion suggestions in Europe, America and China

(1) European Union:

o Strengthen international cooperation to build a regional SAF raw material purchase and product import network.

o Increase investment in PtL-SAF projects and improve supporting infrastructure.

o Adjust incentives to ensure SAF supply and demand balance.

(2) United States:

o Promote industrial chain cooperation and establish a SAF offtaking system.

o Invest in commercialization of AtJ process to reduce production costs.

o Develop long-term tax relief incentive plans to ensure policy sustainability.

(3) China:

o Strengthen internal and external cooperation within the Government to develop a practical SAF action plan.

o Set the SAF mandatory blending ratio to increase market demand.

o Improve the construction of SAF industrial chain and solve the problem of raw material collection and handling.

- Summary

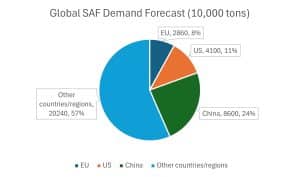

Fig5.Breakdown forecast of world SAF demand in 2050 [5]

As a key means to achieve net zero emissions in the aviation industry, SAF has significant environmental and compatibility advantages. Europe, America and China have developed differentiated SAF promotion strategies according to their own resource endowment, technical foundation and market demand. In the future, with the joint promotion of technological progress, policy support and market demand, the SAF industry will usher in a period of rapid development, providing strong support for the carbon neutral goal of the global aviation industry. At the same time, strengthening international cooperation, improving the construction of the industrial chain, promoting sustainable certification and other measures will further promote the global application of SAF industry.

- Appendix

[1] Kim, Hyeji, and Jacob Teter. “Aviation.” International Energy Agency, 11 July 2023, www.iea.org/energy-system/transport/aviation.

[2] “Developing Sustainable Aviation Fuel (SAF).” Www.iata.org, www.iata.org/en/programs/sustainability/sustainable-aviation-fuels/. Accessed 3 Aug. 2024.

[3] Li Ting, et al. “The only way to zero carbon aviation—Development prospect of next generation sustainable aviation fuel technology.” RMI Innovation Center, Oct. 2023.

[4] “Sustainable Aviation Fuel Outlook / Cena Hessen.” Cena-Hessen.de, 2024, www.cena-hessen.de/en/projects/sustainable-aviation-fuel-outlook/.

[5] Created by Qi’an Fang